The US Debt Ceiling: What it is and Why it Could Be a Problem

The US Government is Facing Major Issues due to Rising Debt

Overview and History:

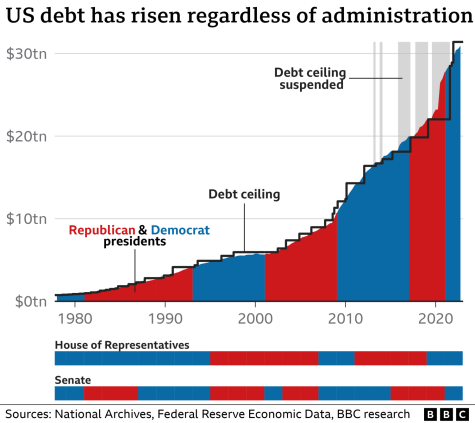

The US Debt Limit, also called the “Debt Ceiling” is defined as, ” the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments” (U.S. Treasury). It is officially called the Statutory Debt Limit. This measure is put in place in order to assist the government with raising funds to pay off all of the yearly expenses that must be paid when the cash to do so is not on hand. The amount able to be borrowed to go into debt has repeatedly increased under each presidential administration in order to adjust for a growing country population and other factors, such as inflation. A key point to understanding the concept is that the limit is not directly a measure of how much debt the government currently has.

Rather, it is a measure of the ability of the government to have borrowing power in the future. The most recent time that the debt limit has led to major arguments as in 2011 and 2013, but before then, very few disputes were had over whether or not to increase the limit and it was usually accepted. According to the US Department of the Treasury, since 1960 the limit has been revised a total of 78 separate times, whether it was a raise or revision of the definition. Over this period it has happened 49 times under Republican Presidents and 29 times under Democratic Presidents.

Rather, it is a measure of the ability of the government to have borrowing power in the future. The most recent time that the debt limit has led to major arguments as in 2011 and 2013, but before then, very few disputes were had over whether or not to increase the limit and it was usually accepted. According to the US Department of the Treasury, since 1960 the limit has been revised a total of 78 separate times, whether it was a raise or revision of the definition. Over this period it has happened 49 times under Republican Presidents and 29 times under Democratic Presidents.

Why Does the Debt Ceiling Matter?

Constantly increasing the limit of debt that the government can have has usually been resolved periodically under many presidential administrations. It seems that because a solution has not been reached, people all over the government are facing blame. President Biden has been criticized for not pushing Congress harder. Contrarily, members all over the Senate and House have been under fire for not quickly agreeing on a solution to help the economy. But, if this path continues lawmakers will probably have more haste to find a solution, as eventually their own salaries will not be able to be paid. Largely, the solution, as most things concerning US law do, will come down to negotiation in the federal government, divided strictly along party lines. This is a bad look for the government, as this issue has usually not had trouble in the past, illuminating the harsh divide not faced between Congress and the presidents’ administration.

I respectfully urge Congress to act promptly to protect the full faith and credit of the United States

— Treasury Secretary - Janet Yellen

How Could Not Raising it Become a Problem?

If the debt ceiling is not raised it could lead to another government shutdown. With no available money on hand, the federal government will have no choice but to close, as they have no available funds to pay employees or make purchases. As many of you may remember the 2018-2019 shutdown, it is unnerving to think that the government is not actively working, with the exception of some essential employees. While it seems the current ceiling of over $31 trillion is an absurd amount of money that could never possibly be spent by one country, when factoring in all of the costs the government is responsible for and the lasting debt the government has built up, it has been growing repeatedly for over 100 years.

Why Should You Care?

For starters, this could lead to yet another decline in a stock market, which has seen many harsh impacts recently from the increasing inflation and interest rates. While this may not be the most important to many other high school students, I know many AMHS students care about the overall state of the market, as they have money invested in some way. The downturn in the market would negatively impact the retirement or college savings of many US households. The costs the US government would need to cut would be likely one of the 2 of: social security payments or the salaries of US military personnel. Neither of these solutions would be preferable because one of 2 large groups, senior citizens or active military would be extremely upset. Both of these are bad options however, there are not many others ways that a major, immediate cut could be found. Another major economic impact would come at the cost of raising interest rates on all types of products such as credit cards and car loans.

How Can a Solution be Produced?

Essentially, lawmakers must come together in a bipartisan agreement in order to raise the ceiling to avoid another economic downturn. It is imperative that this is resolved to stop the previously mentioned potential consequences. Currently as a temporary fix, the US Department of the Treasury is using “extraordinary measures” to save where possible, but this solution cannot hold up for long.The pressure is now on for the President and Congress to find an agreement and quickly work something out to avoid another economic strain on the US economy. One other solution that has recently emerged has been the possibility of a $1 trillion platinum coin. This coin would not spend just like regular currency but would be deposited at the federal reserve and then be utilized to pay off expenses until a more permanent solution is resolved. At the time of publication, no ‘permanent’ solution has been enacted and lawmakers are still at a standoff. If relief does not come and the Department of the Treasury’s extreme measures run out of funding and time, an overall economic downturn and government shutdown will be eminent.

Final Thoughts:

This situation is much more serious than many recognize and should be regarded as such. Make sure to check news outlets for updates and hope that the problem is resolved. Regardless of a solution being reached, the idea that the US government was unable to find a resolution before the ceiling was reached is concerning for the economy moving forward. While fixing the debt limit is crucial, it also must be emphasized that the amount of debt amassed is so large that it is doubtful that the debt will ever be payed back.