The Cryptoqueen

Dr. Ruja Ignatova’s “Biggest Scam” & The Future of Cryptocurrencies.

What even is cryptocurrency? Trying to figure that out amongst the hundreds of understandings that exist is a daunting task. At its core, according to Wikipedia, the currency is a “collection of binary data which is designed to work as a medium of exchange.” Exemplified with that definition, the complicated, technical nature of the industry is easy to dismiss and let go over your head (as it does for me). But as it continues to consume the news, the story of Dr. Ruja Ignatova, a Bulgarian German businesswoman and the self-declared “Cryptoqueen,” conveys the value in responsibly investing.

From what I could understand, crypto operates off the principle that money is only valuable because other people think it’s valuable. For instance, it only works if everybody trusts in it. Historically, digital currencies have trended to fail because they are not state-backed. If you lose your crypto to a hacker, no bank is going to replace it for you. But with Bitcoin, their blockchain database was harder to fake, hack or double spend (BBC). They became of the most successful cryptocurrencies, with a collective net worth to this day of roughly $39.5 billion.

However, it does remain a risky investment; experts don’t advise those uneducated about it to purchase it. After the invention of Bitcoin and its entrance into the mainstream, Dr. Ruja came forward with OneCoin as the next once-in-a-lifetime investment opportunity. Unlike Bitcoin, and its design for a small group who understood the technology to get in early, Dr. Ruja created OneCoin for the masses, for real people to cash in on. Her genius was taking the currency and marketing it through existing multilevel marketing networks. And it spread quickly. Between August 2014 and March 2017 more than 4 billion euros was invested in over 175 countries (NPR).

However, the opening of a long-promised exchange that would allow OneCoin to be turned into cash kept getting pushed back, raising concern among investors. To put it to an end, a large group of European OneCoin promoters gathered in Lisbon, Portugal, in October 2017. Dr. Ruja failed to show up, and nobody knew where she was. Her brother Konstantin took over and essentially became the acting CEO of OneCoin.

So far, OneCoin had largely been avoiding the United States. But in 2019, Konstantin travelled to Las Vegas for meetings. When he was preparing to fly from LAX back to Bulgaria, he was picked up by the FBI and arrested.

Dr. Ruja and Konstantin faced a series of charges – money laundering, conspiracy to commit money laundering, wire fraud and securities fraud (NPR). He brother faced up to 90 years in prison, however, Dr. Ruja, once again, failed to show up to court. OneCoin was a Ponzi Scheme – an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. With little or no legitimate earnings, Ponzi schemes require a constant flow of new money to survive.

In an interview with BBC, investors relayed what drew them in initially was the fear that they would miss out on the next big thing. “They’d read, with envy, the stories of people striking gold with Bitcoin and thought OneCoin was a second chance. Investors might not have understood the technology, but they could see her [Ignatova] talking to huge audiences, or at the Economist conference. They were shown photographs of her numerous degrees, and copies of Forbes magazine with her portrait on the front cover.”

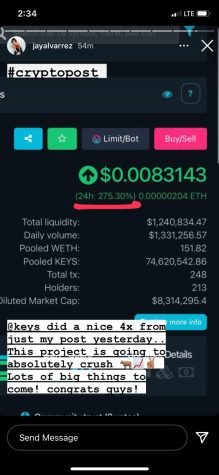

Nevertheless, a few years later, the popularity of altcoins (alternate to Bitcoin or government issued coins) has increased. Hundreds of new cryptocurrencies have released every week across a wide range of forums. In turn, social media influencers have tried to take part in this type of trading activity, gaining considerable profits from advertising it.

In June of 2021 for example, Kim Kardashian put up a sponsored post to her Instagram story, encouraging her roughly 250 million followers to purchase the coin Ethereum Max. It was met with speculation throughout the media as Kardashian boasts no qualifications to advise her devoted fans on finances – her typical content revolves around beauty, fashion, and lifestyle.

“This is not financial advice, but sharing what my friends just told me about the Ethereum Max token,” Kardashian said on her Instagram. “A few minutes ago, Ethereum Max burned 400 trillion tokens- literally 50% of their admin wallet giving back to the entire E-Max community.”

The altcoins influencers promote are commonly known as “pump and dump” scams, in which the company inflates the price of their stock by paying someone to promote false or misleading positive statements in order to sell the stock at a higher price. The company’s worth usually has a brief skyrocket right after being promoted as people start to invest in the coin. In less than a week, the coin’s worth goes down, leaving the investors with far less money than they had initially invested.

Scam coin promotions for the most part are only found on popular influencers’ pages with a big enough platform to cause the spike needed to fuel the “pump and dump.”

In reality, the currency is highly volatile – prices rise and fall, swinging widely day-to-day. They are harder to value, lack regulation (an appeal to some), and face complicated, high taxes. They process large amounts of electricity, and many of their power plants rely on fossil fuels. They are useful in purchasing something you don’t want to be tracked. However, the large platform celebrities have has been useful tool in trying to build credibility for the largely gray area of crypto.

While some countries have enacted blanket bans on Bitcoin, it is hard to actually enforce. Censorship circumvention technologies allow citizens to continue to access the market. However, Federal Reserve Chairman Jerome Powell has confirmed that the U.S. has no plans to ban Bitcoin and cryptocurrencies as of a September 2021 Nasdaq article.

In support of it, many experts have also declared this may be the future of finances and personal investments. If government regulation were to arguably legitimize the industry even more so, people would increasingly face the decision of whether or not to engage with it. Either way, advocating financial literacy with the use of cryptocurrencies plays a role in the investment of it.