Accepting that your Dream College is out of Reach

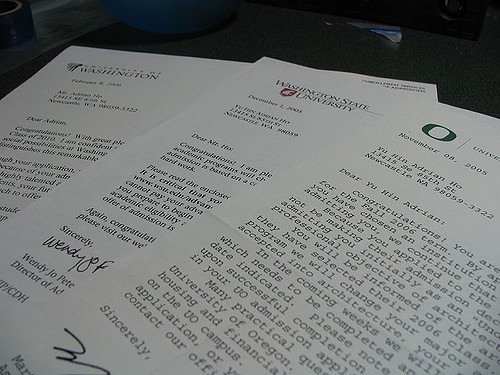

As a senior in high school, my conversations with my parents revolve around three things: college, college, and college. I think I speak for most magnet students when I say we would give anything to be accepted into our dream school. But just being accepted isn’t enough anymore. Unfortunately, since tuition has exponentially skyrocketed over the past half century, prestigious flagship and private universities are growing further and further out of reach even for the most accomplished student.

Financial aid is a slippery slope. Simply because your expected contribution according to FAFSA is X amount doesn’t mean you won’t end up paying double or triple that price in the long run. Most financial aid packages include grants AND loans; grants do not have to be paid back but loans must be paid back. Usually, loans in aid packages are interest free until after graduation which sounds like a blessing but on a $20,000 loan, a full time college student would be lucky to be able to have time to work to pay back maybe a fourth of that amount. After graduation, thousands can be added onto that $20,000 loan after interest is taken into account.

So, with $20,000 already in the hole, that leaves the other $20,000-$40,000 of tuition needing to be covered, depending on the type of university. To recap: let’s assume some university’s annual tuition is $50,000 and your family’s expected contribution according to FAFSA is $20,000. Financial need equals tuition minus expected contribution, so in this instance your financial need would be $30,000. The university you are attending has awarded you a $20,000 loan and a grant (does not need to be repaid) of $10,000; this means they were one of the few institutions across the country that met your financial need. Still, that leaves the $30,000 of expected contribution. Unless your family has an extra $30,000 lying around, you’ll probably have to take out another loan separate from the university, called a private loan. Unfortunately the government and bank must approve this loan, likely not exceeding $20,000. This private loan’s interest starts immediately, so taking out a $20,000 private loan will end up costing thousands of dollars more than $20,000 once interest is taken into account. Still that leaves $10,000 of tuition not covered by any loans.

In conclusion,even if the institution “meets” all financial need, over 4 years you could accumulate nearly $80,000-$100,000 in debt. By attending a slightly less prestigious university or a school other than your dream school, you could set yourself up to begin your career with almost no debt. So the question is what do you value more: attending your dream school or graduating college with little to no debt? Are you planning on attending graduate school? Grad school is just as expensive as college, if not more so. Grad school debt on top of undergraduate debt creates an inescapable hole; sacrificing attending your dream school is worth being able to afford rent, insurance, and transportation after graduation. Make a wise choice. Maintain a good credit score instead of taking on ever increasing debt. And remember your success is based on your effort, not where you attend the next four years of school.