Let’s Get Political!

Part I: Evasion or Avoidance?

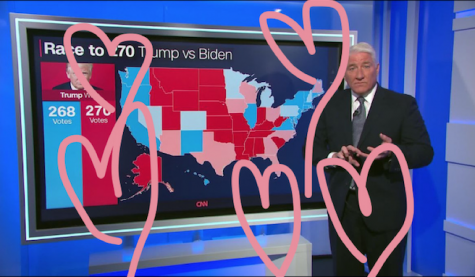

Welcome to “Let’s Get Political” with Lily O! This week we’re talking about President Trump and the New York Times tax investigation! As most of you know, I am not a Trump supporter … I suppose I’m more #SettleforBiden. However, I suggest we all mutually agree to stray away from the CNNs and FOXs of the world and try to stay informed with unbiased, well-researched, facts.

This week’s (9/28) media has been chock-full of headlines with a key number: 750. Although a self-declared multi-millionaire, in 2016 and 2017 Donald J Trump only paid $750 in federal income tax. For scale, the country’s top earners pay roughly 24.0% of their income in federal taxes every year. Hypothetically, let’s say my tik-tok career skyrocketed and I generated over a million dollars last year. I would have shoveled over at least $240,000 to the federal government. Shocking! Right?! Well, let’s dig a little deeper. Is our president really a master tax evader who avoided paying millions of dollars to the very government he presides over or is this, simply put, a twist of the liberal media?

This is not the first occasion Trump has been under fire for his tax returns (or lack thereof). As usual, he broke the chain of his predecessors and chose to not publicly release his tax records. Although the president consistently denied any sort of monetary misconduct, he is facing many allegations along the lines of tax avoidance and fraudulent activity. From 2000-2015 Donald Trump paid $0 in federal income tax for 10/15 of those years. How can this lack of income be explained?

Well, in order to pay federal income taxes your business has to generate money, and according to Trump’s reports, in 10 of those 15 years, he lost more money than he made. In addition to this, according to BBC, he has racked up to $300 million in debts that need to be repaid by 2024. Despite the image of wealth Trump portrays, perhaps he’s not quite the money-making mogul that the media labels him as.

Or maybe he is. Let’s reflect on the New York Times investigation. First of all, it should be noted that a lawyer of the Trump Organization, Alan Garten, deemed the Times’s findings “inaccurate” and reported that “Over the past decade, President Trump has paid tens of millions of dollars in personal taxes to the federal government, including paying millions in personal taxes since announcing his candidacy in 2015”. The real question is: What exactly are the “personal taxes” Trump paid? According to the Times, Garten is not addressing income tax but rather other federal taxes, e.g. social security and medicare. Moving on, Trump reportedly received up to $600 million by 2018 through his involvement with “The Apprentice”. If this is true, how could 10 years of big fat zeros be legitimately reported for his federal income tax? The answer: his personal businesses and investments. President Trump consistently lost enough money through his own personal endeavors to largely offset the significant amounts of money coming from his fame, “Business losses can work like a tax-avoidance coupon: A dollar lost on one business reduces a dollar of taxable income from elsewhere.” In fact, the Times reported that “Overall, since 2000, Mr. Trump has reported losses of $315.6 million…”. With the ability to translate previous losses into future years, Donald Trump used the tax code to his advantage to avoid millions of dollars of federal income tax.

The legality of Trump’s tax “avoidance” has been called into question,;however, no legitimate evidence has been presented that the president committed evasion. The important discussion lies in the morality and equity of taxation concerning America’s 0.01%. How is it justified that Amazon generated over $11.59 billion last year but legally paid $0 in federal income taxes? Are the jobs and money Jeff Besos pumps into the economy worth the tax exemption? Are the loopholes and avoidance methods used by Donald Trump an intelligent manipulation of the IRS or an immoral act of monetary disregard granted only to the 0.01%? Well, that’s up for you to decide.

That’s all for this week folks! See you next time on Let’s Get Political!

P.S.- Don’t forget to register to vote if you are eligible!

Cited Sources

Buettner, Russ, et al. “Trump’s Taxes Show Chronic Losses and Years of Income Tax Avoidance.” The New York Times, The New York Times, 27 Sept. 2020, www.nytimes.com/interactive/2020/09/27/us/donald-trump-taxes.html.

Clement, J. “Amazon Annual Net Income 2019.” Statista, 25 May 2020, www.statista.com/statistics/266288/annual-et-income-of-amazoncom/.

Kurtz, Howard. “New York Times and Trump Taxes: Why It’s Not a Campaign Bombshell.” Fox News, FOX News Network, 29 Sept. 2020, www.foxnews.com/media/new-york-times-and-trump-taxes-why-its-not-a-campaign-bombshell.

Jr., Tom Huddleston. “Amazon Had to Pay Federal Income Taxes for the First Time since 2016 – Here’s How Much.” CNBC, CNBC, 4 Feb. 2020, www.cnbc.com/2020/02/04/amazon-had-to-pay-federal-income-taxes-for-the-first-time-since-2016.html.

“Trump’s Taxes: What You Need to Know.” BBC News, BBC, 28 Sept. 2020, www.bbc.com/news/world-us-canada-54323654.

York, Erica. “New IRS Distributional Data on the Federal Individual Income Tax.” Tax Foundation, Tax Foundation, 17 Oct. 2019, taxfoundation.org/average-federal-income-tax-rates-2017/.